Workday Foreign Currency Revaluation Demystified

Does your company run Workday revaluation but you’re unclear about what it’s really doing? How can you be sure the results are accurate? At month end, revaluation is run, revaluation journals are posted, and the remaining period-close activities carry on. But how do you confirm revaluation picked up and revalued what it should have?

If you recently went live with Workday Financials, maybe you’ve run the Cash to Bank Account Reconciliation report and notice that the balances don’t seem quite right. You might think that perhaps revaluation isn’t calculating as expected. I’ve encountered more than one Financials customer who was unconvinced about the reliability of Workday’s revaluation calculations. Having investigated this, I’ve verified that Workday’s revaluation process is working, just as it should. For every case I’ve evaluated, the source of discrepancies has turned out to be conversion journals and revaluation is not to blame.

This post won’t go into the details of how to configure revaluation for your business. The Workday Community has good documentation to walk you through that – and more likely, your implementation partner has already configured it for you. This post is going to answer the question “What does Workday do when you run revaluation?”

First, let’s understand that the purpose of Workday’s revaluation function is to automate the posting of a journal to:

- Recalculate foreign currency amounts in your company ledger at period end.

- Record the gains and losses caused by fluctuating exchange rates since the transaction date.

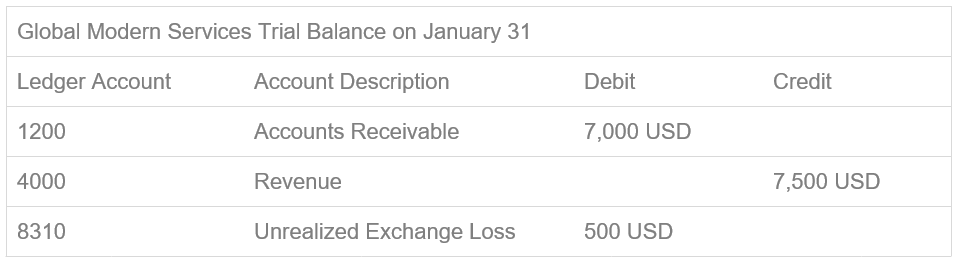

Simplified Example of Revaluation of Accounts Receivable

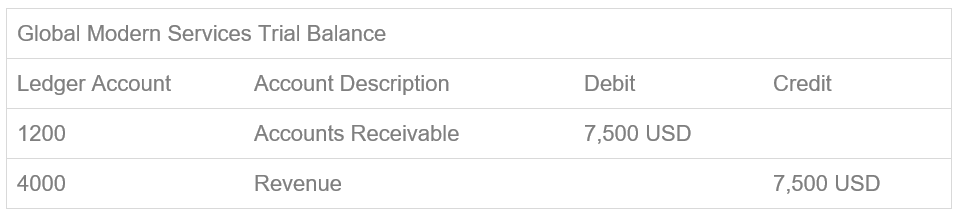

Global Modern Services (GMS) processes a customer invoice on January 5 for 10,000 CAD. The exchange rate from CAD to USD on January 5 is .75. The recorded base amount for the invoice is 7,500 USD.

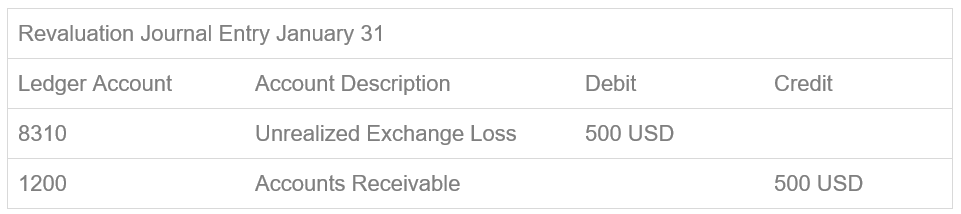

By month-end, January 31, the American dollar has become stronger, and the exchange rate drops to .70. The receivable is no longer worth 7,500 USD. If GMS were paid now, they would receive 7,000 USD. An unrealized loss of 500 USD is booked when the revaluation process is run at month end. Each transaction is evaluated for currency fluctuation between the transaction date and the period end date. The result is one journal entry (commonly a reversing journal) for the aggregated exchange gains and losses based on the revaluation rule or group selected. This example assumes YTD based entries. YTD (Balance) vs. Activity based entries are discussed in the next section.

When the invoice is paid, a realized gain or loss entry is booked at the time of payment and any non-reversed unrealized gain/losses are backed out the next time revaluation is run

Understanding Reversing vs. Non-Reversing Revaluation Entries

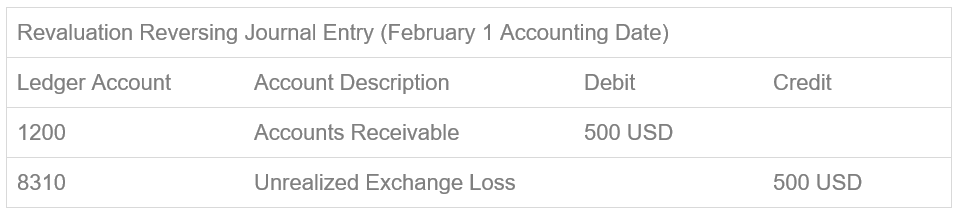

A common configuration question is should I opt-in for reversing entries? The difference between a reversing and a non-reversing entry is this: a reversing entry will post on a year to date (YTD) basis with a reversal journal on the first day of the next period and non-reversing entries post incremental changes each period.

Which option is preferred? The most common configuration is the following combination of settings for balance sheet accounts. If revaluing income statement accounts, choose Activity based entries.

Time Frame = Period

Balance or Activity =Balance

Create Reversal = Yes

Since Activity based entries are incremental for the specified time frame, they cannot be reversing entries. Likewise, Balance based entries should be reversing entries. The combination of Balance based and no reversals is an exception setting and available for use during the conversion process.

Verifying Revaluation Results

The Find Revaluations report is helpful to view which combination of company, rule, book code, and period has been run with a total amount, but it won’t provide details.

Which report will allow you to see the individual gains and losses that contribute to a revaluation entry? The Foreign Currency Revaluation report shows revalued balance sheet accounts for a ledger period end which are drillable to individual journal entries. From there, you can use Workday analytics to view by almost any dimension to help isolate and troubleshoot any discrepancy you are trying to resolve.

Tip

Workday revalues all accounts (as specified in the rules) that have a balance. This includes closed or conversion accounts that have balances in either ledger or transaction currency so be sure to clear balances on closed accounts.

Thank you for reading this post. I’m happy to answer any questions you might have related to Workday foreign currency revaluation and interested in hearing about any of your experiences that you may have to share.