Solving the Asset Depreciation Forecast in Workday

Whether you’re a small startup or a global enterprise, effective asset management is crucial to maintaining a healthy bottom line, ensuring regulatory compliance, and maximizing operational efficiency. Workday Financials streamlines the entire lifecycle of business assets from acquisition to depreciation, maintenance, and eventual disposition. There is one glaring reporting limitation surrounding depreciation expense, however, that many customers run into: reporting on period-by-period depreciation expense for existing assets when their assets have useful lives extending beyond the fiscal periods within the tenant.

Typically, if you run the Workday Standard Report “Asset Depreciation Forecast Detail”, you can see the forecast asset depreciation for your in-service business assets for a prompted time range, however, this report only returns data through the fiscal periods within the tenant. If you are like many clients who do not create the next fiscal year until year-end close activities, you can only use this report to forecast asset depreciation until the end of the current fiscal year — not very useful when you certainly have assets with a useful life beyond one year.

This system limitation has to do with how Workday derives the “Period Ending Date” for depreciation lines. When you create an asset depreciation schedule, Workday will generate depreciation lines ordered sequentially by a “Depreciation Period Number.” It will look at the fiscal schedule to determine the period ending date for the fiscal month in which the depreciation line exists. For example, if you set up a monthly depreciation schedule and the depreciation line relates to January 2024, Workday will look at your fiscal schedule for January 2024 and return a period ending date of 1/31/2024. When the fiscal period does not exist in the tenant, the period end date returns blank.

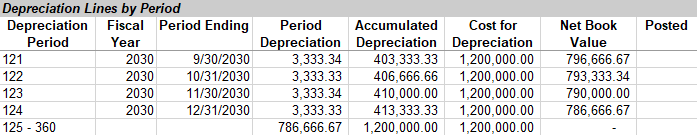

Below is a visual representation of what this looks like on the Depreciation Detail tab for an asset that has depreciable amounts beyond 2030 when the tenant only has fiscal periods through 2030. Notice that all depreciation beyond 2030 is aggregated into a single summary line:

The key thing to note is that the depreciation lines do exist in the tenant and are reportable, however, the key field that indicates the period the expense will hit in returns blank. If we wanted to view depreciation expense for depreciation lines beyond 2030, we need to find a new way to fill out “Period Ending Date” for a depreciation line without using the delivered “Period Ending” field from Workday.

By utilizing the “Depreciation Lines” data source with calculated fields on the Depreciation Line Business Object, you can logically derive these period end dates without the need for fiscal schedules. Employing a combination of Evaluate Expression, Lookup Related Value, Extract Single Instances, Build Date, and Increment/Decrement Date calculated fields, you can create this period end date on the Depreciation line Business Object. The field can look at the period ending dates from other depreciation lines, extract relevant information from the depreciation profile, and ultimately output the correct period ending date for all depreciation lines in the out years.

The general concept of this approach is to take the currently evaluated depreciation line, look up the depreciation schedule for the depreciation line, and return the last depreciation line for the schedule that has a period ending date. Then, by taking the depreciation period number and Period Ending Date from that line (found in a Lookup Related Value calculated field), you can increment and decrement that date to derive the final period ending date for your currently evaluated depreciation line.

This calculated fields allows you to reconfigure the Workday-Delivered “Asset Depreciation Forecast” and “Asset Depreciation Forecast Detail” reports, returning results beyond the time limitation of fiscal periods within the tenant.

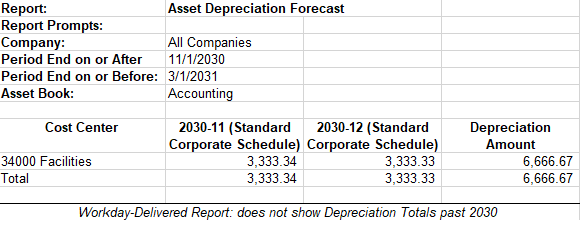

Workday Delivered Report:

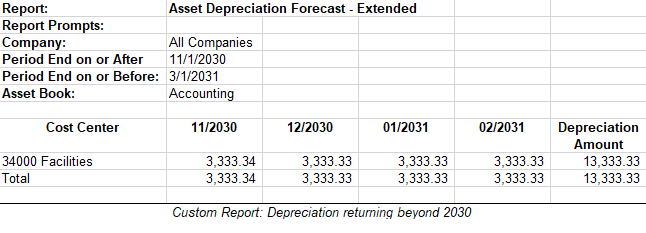

Custom Report for same parameters:

Beyond simply extending the time horizon for these reports to be viewed in the UI, this calculated field breakthrough is useful in other scenarios, primarily in integrations to financial planning software such as Adaptive Planning. With the ability to report your asset depreciation lines with related dates regardless of the period the depreciation line belongs to, you can also integrate that data into financial planning software to obtain a more accurate view of existing asset depreciation for long-term plans. Rather than being required to use any type of formula or model to derive this existing asset depreciation expense in the out periods, you can simply take the exact depreciation expense data coming out of Workday and load that into your long-term forecasts to represent the long-term current asset depreciation expense.

If you are interested in deploying these calculated fields and reports for a more accurate view into your current asset depreciation, I and the Kognitiv team can make this happen in under a week. Let’s chat!